35+ Added principal mortgage calculator

Top online personal loan providers in the US market include. Most people probably know that mortgage payments are due on the 1st of the month but many loan servicers those who collect your payments will allow you to pay 15 days late each month.

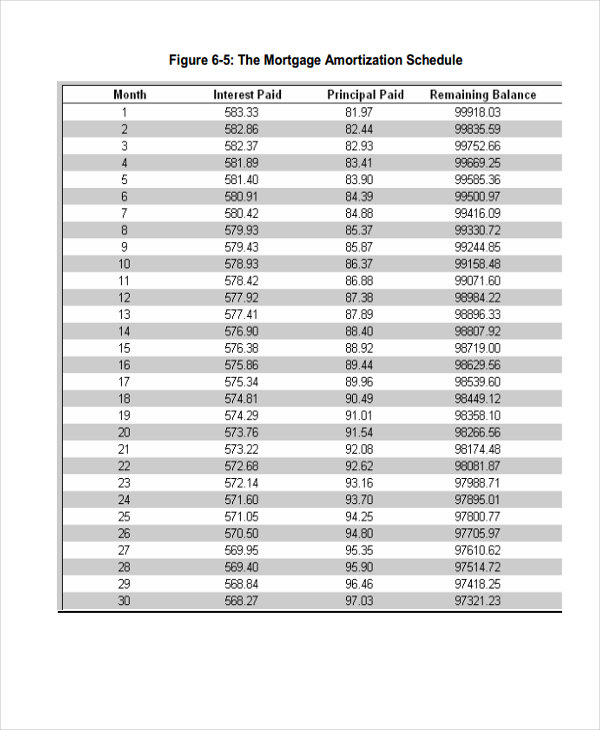

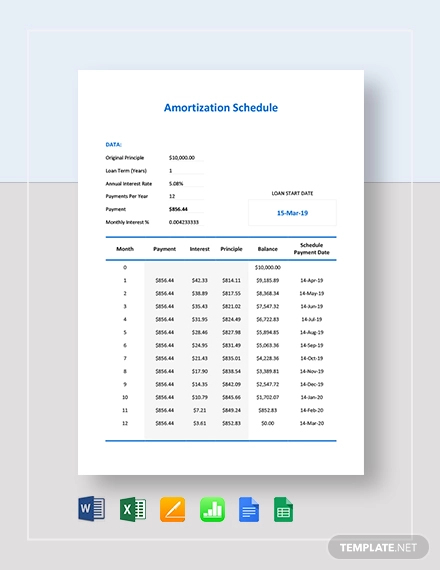

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Mortgage Payoff Calculator.

. And its typically added to your mortgage principal. Payments per year - defaults to 12 to calculate the monthly loan. The Annual Percentage Yield assumes that dividends remain on deposit and are added to a starting principal balance of the minimum amount to.

Thats because any interest owing is paid first. 35 or even 40 years. If a mortgage is for 250000.

PST on mortgage default insurance or CMHC insurance in Quebec. Our Closing Costs study assumed a 30-year fixed-rate mortgage with a 20 down payment on each countys median home value. The Ratehubca Quebec Mortgage Calculator also calculates your mortgage payments based on rates specific to Quebec.

Paying off your mortgage may seem like a distant dream at first. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which represents 70 to 90 of all mortgages.

The principal of your mortgage would be 100000. Requires 035 annual mortgage insurance fee No prepayment penalty. A guide to better understanding closing costs is.

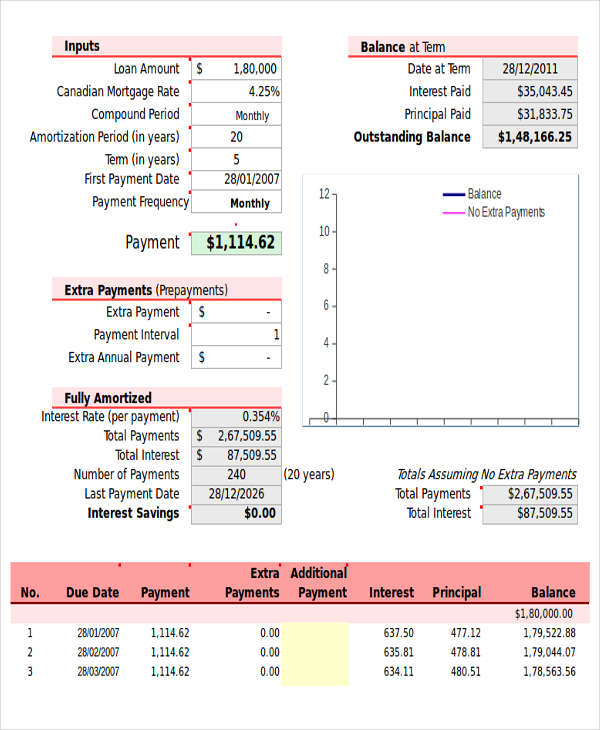

Shows total interest paid. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Some mortgage lenders offer 35-year and even 40-year amortization periods.

You made a 50000 down payment and took out a mortgage on the rest. The good news is as you continue to make mortgage payments and the principal is reduced a higher portion of your payments will go toward paying down the mortgage principal. Mortgage borrowers with a limited downpayment will likely be forced to pay for property mortgage insurance PMI.

Once we calculated the typical closing costs in each county we divided that figure by the countys median home value to find. Mortgage default insurance is added onto the total cost of your mortgage and is paid off along with your monthly payments over the lifetime of the mortgage. Then the percentage is added on top of your principal balance.

Fixed Rate Home Loan Principal and Interest 2 Years LVR 80 Low rate home loan with added benefits add offset for 010. How to pay off your mortgage faster. The interest of the skipped payment will be added to your mortgage principal lengthening your amortization period and resulting in more interest paid in the long-run.

The county with the lowest tax burden received a score of 100 and the remaining counties in the study were scored based on how closely their tax burden compares. The first tab offers an advanced closing cost calculator with detailed and precise calculations while the second tab offers a simplified closing cost calculator which shows a broader range of estimates. Mortgage rates tend to follow movements of the 10-year United States Treasury.

Of up to 15 days to pay without penalty. The third tab shows current Boydton mortgage rates to help you estimate payments and find a local lender. If you make a principal-only payment you are paying back your loan sooner and lowering the amount of interest you have to pay over time.

For example suppose you bought a house for 150000. But mortgage lenders generally provide a grace period. Finally each county was ranked and indexed on a scale of 0 to100.

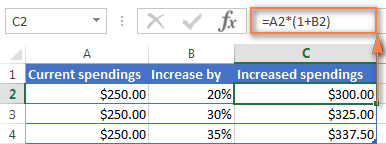

Our mortgage refinance calculator can help borrowers estimate their new monthly mortgage payments the total costs of refinancing and how long it will take to recoup those costs. See how your monthly payment changes by making updates to. In the compound interest formula the principal is symbolized by a P just as in the simple interest formula.

Save thousands. Meaning its only late if paid after the 15th of the month. Refinance Interest Savings Calculator.

Use this free Texas Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. Interest is the cost of borrowing that money and is added to the principal. Related Mortgage Calculator.

You can check your budget using a mortgage affordability calculator. While there is no set. Mortgages are how most people are able to own homes in the US.

A mortgage usually includes the following key components. The funding ranges between 14 to 36 of your loans value. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

A principal-only payment is applied directly to the original amount that you borrowed and agreed to pay back. These are also the basic components of a mortgage. We then added the dollar amount for income sales property and fuel taxes to calculate a total tax burden.

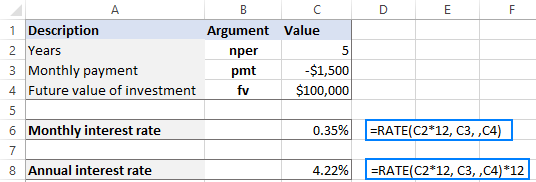

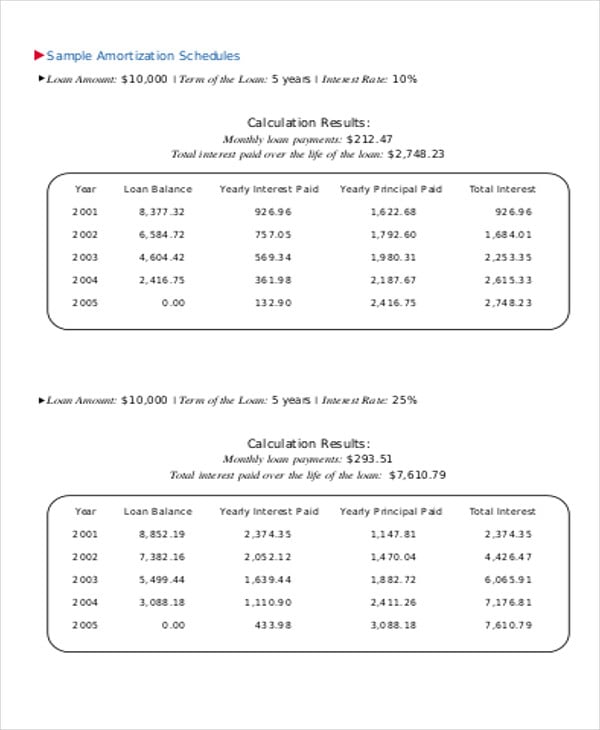

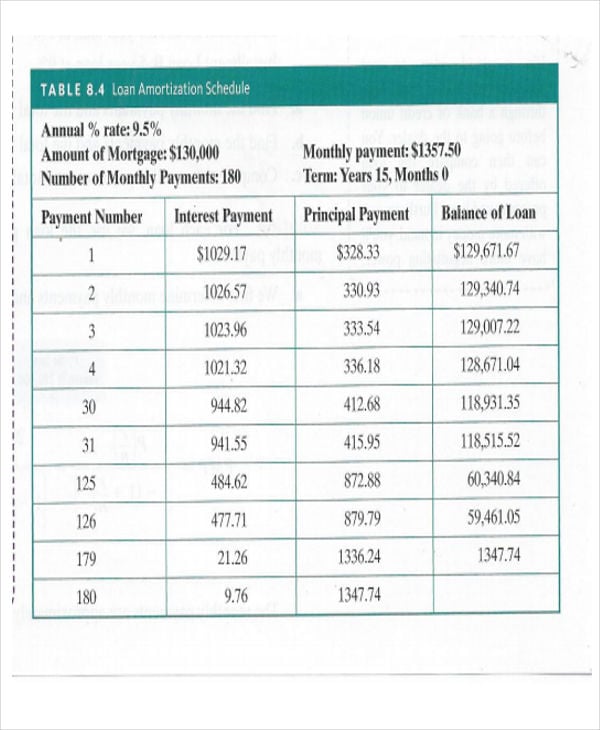

This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate. Microsoft Excel Mortgage Calculator Spreadsheet Usage Instructions. Marcus by Goldman Sachs.

A mortgage is high-ratio when your down payment is less than 20 of the property value. The monthly housing costs not only include interest and principal of the loan but other costs associated with housing like insurance property taxes and HOACo-Op Fee. The calculator updates results automatically when you change any input.

Mortgage principal Mortgage principal is the amount of money you borrow from a lender. 30 Year Mortgage Calculator. 05 of PMI insurance will automatically be added to monthly housing costs because they are assumed to be calculations for conventional.

We considered all applicable closing costs including the mortgage tax transfer tax and both fixed and variable fees. Get a 70 star NatHERS rating or higher for up to 159 discount on your variable rate home loan TCs apply. Allows extra payments to be added monthly.

Calculate what your mortgage payment could be. Best online personal loan providers.

Pin On Dribbble Ui

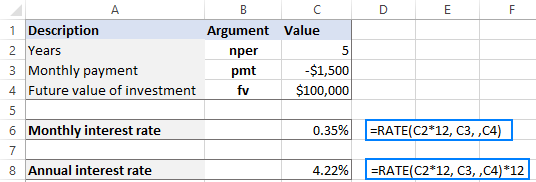

Using Rate Function In Excel To Calculate Interest Rate

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

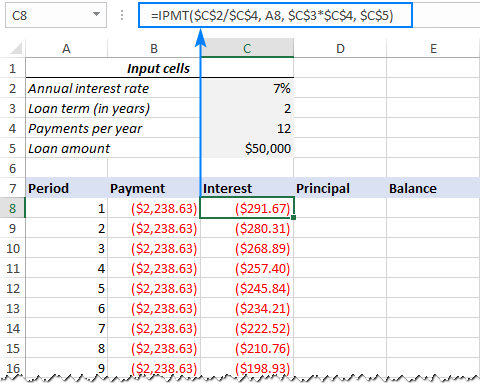

Free Amortization Schedule Free Pdf Excel Documents Download Free Premium Templates

29 Amortization Schedule Templates Free Premium Templates

29 Amortization Schedule Templates Free Premium Templates

Kenya Silver Ceramic Wall Tile 8 X 24 In Bathroom Remodel Master Bathroom Remodel Shower Small Bathroom Makeover

Tables To Calculate Loan Amortization Schedule Free Business Templates

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

29 Amortization Schedule Templates Free Premium Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

Free Printable Debt Payoff Coloring Page Credit Card Debt Payoff Credit Card Tracker Credit Card Interest

How To Calculate Percentage In Excel Percent Formula Examples

35 Awesome Buddha Garden Design Ideas For Calm Living Freshouz Com Buddha Garden Garden Statues Zen Garden Design

29 Amortization Schedule Templates Free Premium Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

29 Amortization Schedule Templates Free Premium Templates